Bubbles & Beliefs: How long until they pop?

A reflective exploration of financial market bubbles, ecological overshoot, and the fragile beliefs underpinning them — this article examines how optimism drives value, what happens when it falters, and how to build true resilience in an uncertain future.

September has been another month of travelling. Both physically — on a number of Italian, German, and French trainlines (a far more pleasant experience, for the record, than what’s on offer in the UK) — and mentally, through contrasting worldviews about the future.

It feels as though I’ve visited both ends of the ideological spectrum on capitalism.

On one end, I had the privilege of spending time with Barbara Williams, a mathematician-turned-activist advocating for ecological justice through her Poems for Parliament initiative. As a fellow mathematician, she enticed me in with a deceptively simple equation that underpins much of the Degrowth movement. She talked through the profound long-term consequences of ecological overshoot and economic overreach that stem from this. More on that shortly.

On the other end of the spectrum, I had the privilege of attending a very different gathering: a prestigious financial risk management conference hosted by one of main derivative exchanges. It was a lavish affair — participants were showered with gifts, from eye-massaging sleep masks, to Adidas trainers emblazoned with sponsor logos (so you can advertise for them while out at the pub?!). Despite the extravagance, the event offered fascinating insights from some of the sharpest minds in financial risk.

And oddly enough, both ends of this spectrum converged around one shared theme: bubbles.

The Sparkle of Prosecco vs. the Froth of Markets

My favourite kind of bubbles? The ones pictured above — cultivated in the vineyards of Valdobbiadene, nestled in Italy’s Veneto region. This is the birthplace of true Prosecco. I was lucky enough to return this month to one of my favourite spots in the area: L’Osteria Antica di Guizza. There, you can sip crisp, small-batch Prosecco that never makes it beyond the region’s borders. It tastes especially sweet after a four-hour hike through the surrounding woods!

But not all bubbles are so benign.

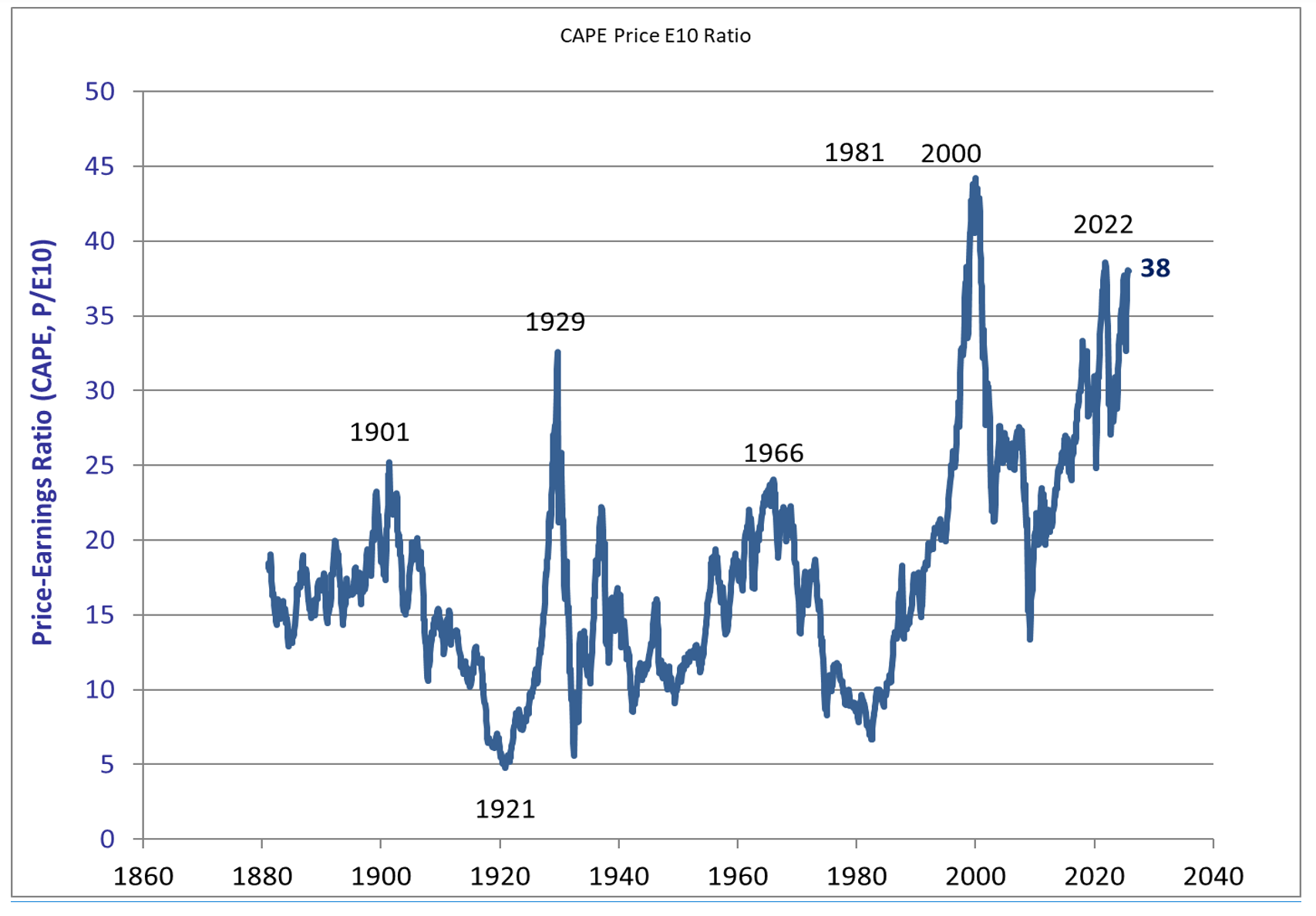

Let’s turn to the US stock market. A simple graph tells the story. It shows the price investors are willing to pay as a multiple of average company annual earnings. Historically, this has averaged around 17x. Today, we’re above 38x — more than double — it is difficult to deny there is a high level of optimism baked into current market prices.

Price Earnings ratio of the S&P 500 (US stock market index), as calculated by Robert Schiller:

Yes, part of this is driven by the AI boom, but other sectors are rising fast too. Most of our pensions are heavily invested in stocks, and US stocks in particular. It is crazy to think, how much of our future financial security is tied not just to company earnings, productivity or innovation, but to the future collective mood of investors.

And moods, like bubbles, are fragile.

How Long Until It Pops?

That’s the trillion-dollar question. These spikes in valuation don’t tend to last. And with everything happening in the world — geopolitically, ecologically, socially — it’s hard not to imagine potential pins.

So if/when the bubble pops, how long would recovery take?

In recent memory, we’ve been conditioned to expect quick turnarounds. After COVID hit, the stock market rebounded in just six months. The 2008 global financial crisis took longer — around four years.

But there’s a much longer, sobering story worth revisiting.

Remember Japan?

I was lucky enough to visit Japan in 2009 — a country where high-tech futurism coexists with moments of stunning simplicity.

In the mid-1980s, Japan was seen as a threat to US economic dominance — not unlike the way China is perceived today. The Nikkei index multiplied more than fivefold during that decade. Speculation ran rampant, and the belief in endless wealth seeped into everyday life. It felt like everyone was a stock market millionaire.

And then… the crash.

After the Nikkei peaked, it took over 30 years to recover to similar levels. For those who invested near the top, it was a generation-long wait. The timeline that sits between many of us, and when we expect to retire. There was no dramatic government bailout or central bank miracle. Just stagnation.

And that’s the concern with our situation today. Most G7 nations now face risky or unsustainable fiscal positions. According a recent report from Insight Investment, only one of the G7 is currently in a stable financial condition (Germany). If a crash were to happen, would governments even have the capacity — let alone the political room — to intervene? That is what makes this particular bubble more worrying than most.

The Bigger Bubble: Ecological Overshoot

But let's get back to Barbara’s equation — and a different kind of bubble entirely.

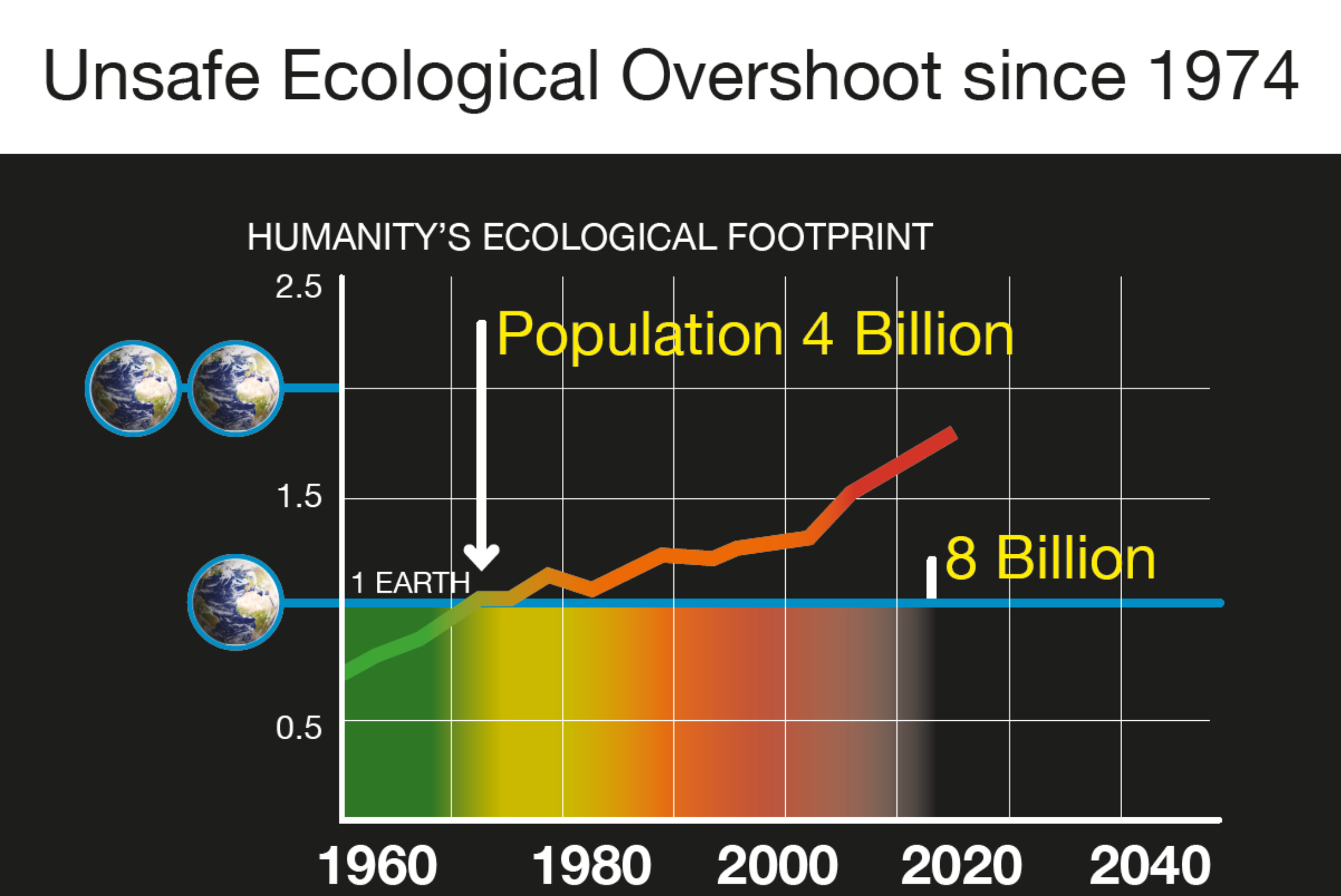

Also a different graph. Academic research underpinning this, shows that humanity has been living in ecological overshoot for some time. We're consuming more than the Earth can regenerate each year — not just leaving no space to support humanity sustainably, but also for the rest of nature, upon which our own life-support systems depends.

And yet, we’re still on track to add another 1 billion people between now and 2050 (even with the optimism of the Economist's recent article) — all needing food, water, energy, and smartphones.

Yes, there are many assumptions built into these models. But the fundamental truth is this: everything in our economy derives from nature, and nature is declining. Deep down this is something we can all appreciate.

At some point, something has to give. The physics of planetary limits are real. And yet, it’s difficult to connect the dots between long-term realities to short-term financial decisions and investment theses. Just like with overvalued markets, we can often sense something’s off — but still struggle to change course.

Will Belief Be the First to Crack?

That’s the paradox. On paper, many of these risks are clear. But markets continue to rise. Why?

Because markets are built on belief — belief in future profits, in perpetual growth, in the ingenuity of the system to solve problems as they emerge.

If that belief begins to wane — not just among fringe thinkers, but within the mainstream — the financial impact could be significant. If global optimism dissipates and struggles to return, then so does a large part of the price on financial wealth.

But it's not just belief, there are direct consequences too, as we push harder and harder on the Earth's systems. As German insurer Allianz continues to point out, more and more of the world is becoming uninsurable due to extreme weather. When homes can’t get insured, they can’t get mortgages. When businesses can’t insure assets, they can’t raise loans. Assets get written off. Defaults rise. Economic systems start to fracture. And governments, already under strain, may be unable (or unwilling) to step in.

It's not just optimistic belief in earnings growth, but the capacity to earn that is also at risk.

How Do We Stay Resilient?

So where does that leave us?

The oldest rule in finance still holds: diversify. But not just across regions or asset classes. That is still important. But we also need to diversify beyond financial wealth itself.

Yes, pensions still matter. Matching contributions from employers are essentially free money. It makes sense to take advantage — but that's different to planning to be entirely reliant on our pensions, and more broadly financial investments, later in life.

Ask yourself:

- What’s your encore career? What’s the kind of work you love — and wouldn’t mind doing later in life — that you can do flexibly on your own terms, and is valuable for the world we are moving towards?

- Could that evolve into a side business, or a royalty-based model that lets you step back over time?

- Is there a way to invest in climate-resilient property — although the property market is also subject to bubbles in valuations. Incomes tend to be more stable, and shelter will always remain a basic human need, even in crisis.

- What about non-financial assets — health, relationships, community? These too require intentional investment, but they pay lifelong dividends.

Ultimately, resilience is about staying nimble. Keeping options open. Building capacity to adapt.

The Mindset Shift Ahead

As with any crisis, mindset is key.

We’re already locked into a certain level of climate damage. That’s the hard truth. Many lives — especially in vulnerable regions — will be lost. But for those who live through what’s coming, there will be a profound shift.

Think again of Japan. The crash of the 1980s reshaped cultural attitudes. Gone was the unshakable belief in wealth without limits. In its place emerged a society that values simplicity, humility, and long-term thinking.

Perhaps the crises ahead will lead us somewhere similar — toward a future defined not by power and arrogance, but by compassion, community, and ecological awareness.

A Harmonious Future, Still Possible

The bubbles we see today — in financial markets, in planetary systems, even in our collective optimism — may indeed burst. But what comes after need not be despair.

What comes after can be deliberate. Purposeful. Regenerative.

The goal isn’t just to protect ourselves financially. It’s to align our lives with the world we know is coming — and to help shape that world with clarity, courage, and care.

Let’s not just wait for the future.

Let’s meet it head-on.

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.