Fixed Income in a Climate-Changing World

Discover how bonds — often overlooked in impact investing — can become powerful tools for climate resilience and purpose-driven returns in a rapidly changing world.

Fixed income, fixed interest — or simply bonds. These are investments where you hand over capital upfront in exchange for a stream of defined income payments over time. For decades, they’ve been considered the steady foundation of a portfolio. The safe, dependable counterweight to riskier assets like shares.

But in recent years, that reputation has started to wobble.

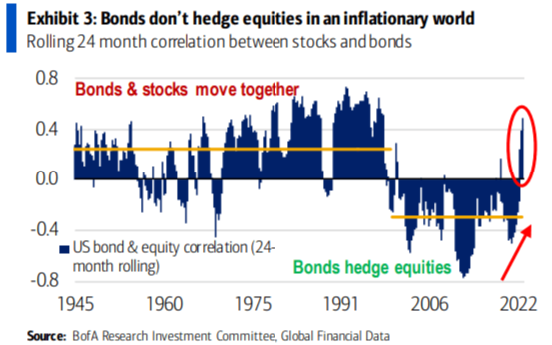

The idea that bonds rise in value when shares fall has not been holding up as well lately. In fact, that comforting relationship c where bonds act as a cushion — was an isolated feature of the first two decades of this century. If we zoom out further, history tells a different story — see chart below. There have been long stretches, especially during inflationary periods, where bonds and equities fell together in a crisis.

And some now wonder if we’re entering a similar era?

Government debt is rising unsustainably in many countries — raising questions about the long-term safety of government bonds. Just think back to the "Truss-enomics" of the UK’s gilt crisis in 2022, where UK government bonds fell even more than equities over the year. Or look to the "Trump-enomics" of the US right now, where high-spend, low-tax policies are unsettling the markets.

At the same time, climate disruption is intensifying. The costs of future pandemics, extreme weather, and global adaptation efforts may place severe pressure on public finances in future. That’s unlikely to create the calm, stable backdrop bond markets rely on.

There’s also inflation to consider. As my actuarial colleagues put it (see article), the next few decades may bring higher and more volatile inflation than we’ve been used to. Think food price spikes from crop failures in extreme weather events. Scarcity of resources needed for the Net Zero transition. And the long-overdue shift to pricing in the true environmental costs that polluters once ignored.

However, that all said. Fixed income assets still make up around 54% of all investible assets worldwide (according to MSCI). To overlook them would be to ignore a huge part of the financial system — and a major opportunity to direct capital towards impact.

Even in an uncertain world, there’s something powerful about receiving a steady stream of income from your investments. That predictability can bring calm. It can also create flexibility in times of stress.

Given bonds have lost their "shine" of late, how can we get more value from investing in them?

Some bonds — or fixed income assets — can do more than generate income. They can offer a practical, tangible way to deliver planet-positive impact through your investment portfolio.

Read on to explore how.

Disclaimer: This article does not provide investment advice. It is meant to educate you, provide key insights to consider, and discuss the pros and cons of investing in these types of asset, to help you in making your own informed investment choices. Do your own research before considering any investment.

Two Climate-Positive Fixed Income Ideas

1. Green Bonds: Simple and Liquid

Green bonds are designed to fund projects that support climate and environmental goals — like wind farms, clean transport, or sustainable buildings.

Points worth considering:

- Performance: There is an added dimension to their investment performance, relating to the "green premium". As large investors decarbonise their investment portfolios, they may be willing to accept a lower returns in compensation for a positive climate impact. This impacts all investors too. That said there are times when green bond indices have outperformed their conventional peers.

- Diversification: Because green bonds typically fund specific areas such as renewable energy or low-carbon transport, investing in them may mean putting "your eggs in fewer baskets". However, there are plenty of green bond funds available that maintain a diversified investment strategy, spreading exposures across different sectors and countries.

- Credibility: Standards like the ICMA Green Bond Principles, the Climate Bonds Standard, and the EU Green Bond Standard help keep things on track. These frameworks set clear expectations around how money is used, how projects are selected, how funds are managed, and how impact is reported. That reduces greenwashing — and increases trust.

These four pillars — use of proceeds, project selection, management of funds, and impact reporting — are what bring structure to the space. And with third-party verification built into many certification schemes, they’re not just marketing claims — they’re measurable commitments.

🔍 Risks to watch: Green bonds are still bonds. They can fall when interest rates rise. And not every "green" label is equal — so stick to certified funds and verified issuers.

2. Community Energy Bonds

My journey with this type of asset started several years ago.

I invested in a community bond issued by Empower Community Foundation ("ECF") — a not-for-profit organisation developing solar parks and returning profits to local groups.

Note: This specific asset is no longer available for investment, and so it is not possible for me to offer investment advice on it. I talk about it as an example only.

Here’s what made it stand out:

🌱 Tangible Impact: Although the bond does help to re-finance a renewable energy asset. The key driver is that surplus income is redistributed to support climate action, education, and energy poverty relief. Over the bond’s term, £1.3 million is expected to be directed to community grants. Once the initial debt is repaid (by 2036), even more of the surplus will support local sustainability projects. That’s impact with staying power.

It’s a smart impact model — by prioritising community distributions only after meeting bond repayments, it creates a built-in buffer that can help protect investors in times of stress, while still delivering meaningful benefits to local communities.

For example, ECF has provided funding to support mental health, family stability, and poverty reduction in one of Wiltshire’s most deprived areas, while also helping to fund energy efficiency upgrades in community halls across Edinburgh. All donations from the investment have been amplified through ActionFunder.org, which pairs them with corporates looking to match charitable giving.

💷 Investment Terms:

- Issuer: Empower Community Foundation

- Rate: 4.25% per year, inflation-linked (RPI)

- Term: 16 years (repaying in annual instalments from 2023–2038)

- Minimum Investment: £50

- Eligibility: Innovative Finance ISA, so that returns have been tax-free

It was a long-term commitment — but one that aligned deeply with my values. And for me, the ability to combine financial return with real-world regeneration was worth giving up the ability to access all my capital over the 16 year period.

Comparing Pros & Cons

This table provides a quick summary comparison of pros & cons:

| Feature | Empower Community Bond | Listed Green Bond Fund |

|---|---|---|

| 🌱 Impact | Direct, visible local benefit — supports communities and resilience | Broader environmental projects across multiple sectors |

| 💷 Income | Fixed + inflation-linked (RPI) | Fixed or floating — not always inflation-protected |

| 💧 Liquidity | Illiquid — held to maturity | High — can be traded daily on investment platforms |

| ⚖️ Risk Profile | Project-specific; depends on local execution and governance | Diversified across many issuers, sectors, and geographies |

| 🔐 FSCS Protection | ❌ Not covered by the Financial Services Compensation Scheme | ✅ Typically covered by FSCS if held via regulated platforms |

| 🏗️ Asset-Backing | Partially secured against physical assets (e.g. solar parks) | May be unsecured or reliant on issuer’s overall balance sheet |

| 📄 Certification & Oversight | Platform-vetted; governed by a social purpose trust | Often certified (e.g. Climate Bonds Standard, ICMA, EU GBS) |

Empower worked for me because I was looking for tangible impact, not just income. I was also fine with keeping my capital tied up for 16 years, and accepting no government deposit protection, in exchange for the security of being backed by physical solar park assets.

But green bond funds are more flexible, and may be better suited to those needing the ability to access your capital over a shorter time-frame, or looking for broader diversification.

Each option has a place, and they can also complement each other.

It’s worth also noting that the expected returns from such bonds are lower than what you might get from higher-risk assets. Personally, I balance this by combining them with other higher-risk investments that offer more potential for long-term growth.

The Evolving Role of Bonds in Your Strategy

Once a go-to hedge against equity risk, bonds aren’t behaving quite like they used to. Rising inflation and central bank policy shocks mean fixed income and equities now move more closely together. This correlation shift has made traditional diversification strategies less effective — and prompted many investors to rethink how they use bonds.

So as well as climate impact, why else would you still hold them?

One word: Income.

That income — especially from bonds that pay out annually or semi-annually — can be reinvested consistently. This helps you benefit from pound cost averaging: buying into riskier assets (like equities) gradually, at different price points. It helps to reduce timing risk and stay calm through market cycles.

You could argue that capital might be best invested in equities to begin, but given their expected volatility, there is the risk that you go all-in at the height of a the market cycle.

Equity markets can crash in a big way. After the 2001 and 2008 crises, equity markets took years to recover. If we are to experience a repeat today? Investors who have regular cash flow from bonds may be able to reinvest during a future dip — positioning themselves well for the bounce-back.

And in an age of climate volatility, these crashes might become more frequent. Having a reliable, re-investable stream of income could be a crucial source of resilience.

But it’s about balance.

Bonds today are less about protection — and more about strategy. They’re no longer the antidote to volatility they once were, but they remain a valuable tool for:

- Smoothing out your portfolio journey

- Creating liquidity for future opportunities

- Backing sectors and systems aligned with your values

So instead of asking "are bonds still worth it?" — the better question might be "what role should bonds play now?"

The answer will differ for everyone. But in a climate-changed world, bonds aligned with planetary outcomes offer something conventional markets can't: a chance to earn steady returns — while helping the world stay steady too.

How to Start?

For green bonds:

If you're looking for sustainable investment funds — green bond funds, but also other types of asset class too — Fund EcoMarket is a great resource.

Fund EcoMarket is a free, independent database used by UK financial advisers to compare and understand sustainable, responsible, and ethical investment funds. It includes a wide range of fund types, from equity and multi-asset portfolios to fixed income options like green bond funds — all brought together in one place to help match values with investment choices.

Although designed for professionals, it’s fully open to the public and makes values-based investing more accessible by breaking down jargon and improving transparency. The platform is supported by fund partners, which helps keep access free and unbiased for everyday users.

📝Just to note: Fund EcoMarket provides fund information and filtering tools — not personal investment advice. It’s a powerful research tool to support your own decision-making.

For community energy bonds:

As a suggested action to begin, 👉 Try this AI prompt:

“List out some of the Innovative Finance ISA platform providers for retail investors in the UK that focus on sustainable investments.”

👉 Suggested Tip: Go with regulated platforms that do their homework — those that check each project thoroughly, explain the risks clearly, monitor results, and give you easy access to your investment’s performance.

You don’t have to choose one over the other. For many, a mix of both can work well — combining the liquidity and scale of listed funds with the depth and locality of community-led change.

Closing Thoughts

In a world where volatility is the new normal, bonds still have a role to play. But by choosing climate-aligned options, they can do more than just earn income — they can fund change.

Whether through green bond funds or deeper-impact community projects, your money can help build the energy system of the future, support those most affected by climate change, and create returns that go beyond financial.

If more of us were to allocate fixed income into climate-aligned options, it could help shift the needle. Because every investment is a signal. Every pound you put to work says something about the future you want.

In a world where money talks, let yours speak for the future you believe in.

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.