Investing in Your Electricity Price — and the Billion-Dollar Idea from Bhutan

Can your home upgrades pay you back — and could the UK turn excess wind into wealth? From heat pumps to Bitcoin mining, explore bold ideas that blend energy efficiency with financial return, inspired by Bhutan’s billion-dollar move.

Introduction: Turning Old Walls into New Ideas

I’m in the final throws of renovating an old Edwardian house — a property investment that’s been a patience-testing experience. Managing builders, chasing timelines, juggling decisions… it’s been stressful, to say the least! But thankfully it’s coming to an end, and really pleased to see the realisation of our initial vision finally take shape.

This place was built in 1906, and part of the challenge has been finding the right balance: modernising it for comfort and efficiency, without stripping away all its original character. A lot of UK homes are like this — beautiful, but badly insulated and built long before energy efficiency was a "thing". And if we’re serious about reaching Net Zero, fixing our old housing stock is one of the biggest challenges we have as a nation.

One of the best ways we’ve added value during the renovation is by improving the energy rating — insulation, better windows, and swapping out the ancient gas boiler for a heat pump.

This aspect alone has sent me down many a rabbit hole of research. What works? What’s hype? What’s actually cost-effective? And it’s not easy, especially with the increasing amount of myth, misinformation and political pushback being perpetuated around Net Zero and alternatives to fossil fuels.

So that’s what this week’s article is about — sharing some snippets of what I’ve learned along the way, cutting through a few of these myths, and highlighting potential financial opportunities.

Here is an idea that stuck with me through all this: what if, instead of just investing in property or pensions, we started thinking about investing in our electricity price?

It won’t fund your retirement, sure — but energy is something we all pay for, every single day, for the rest of our lives. Making smarter decisions about how we use and buy electricity could add up to real savings over time.

A big conundrum: in the UK we have some of the highest electricity prices in the world. It is down to the way our markets are structured. Energy providers get paid the same price — that of the highest cost energy: gas. So despite all the efforts to build more renewables, the benefits of cheaper energy they bring don’t filter through into the end price, until we ditch the gas.

A heat-pump may be 4x more efficient at heating a house than a gas boiler. But simplistically, our national energy grid is like one big gas boiler. So we don’t necessarily see the benefit of that in the (average or peak) electricity price.

Adding to the conundrum: what’s also weird. As a country, at times we sometimes produce too much wind. Our government often — particularly overnight — has to pay windfarms to turn themselves off.

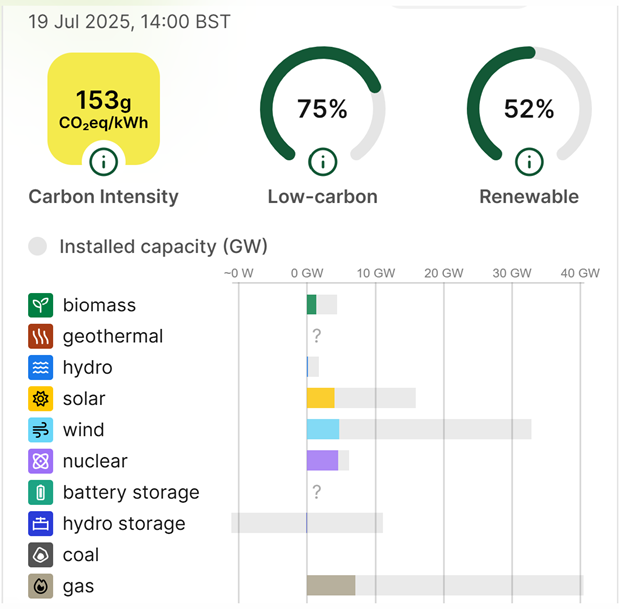

The following graph comes from a favourite website of mine (as a geography and renewable energy geek) (another similar one is here). As I’m writing this article, it shows that wind energy is currently supplying 16% of our electrical needs. But we’re only operating at 14% of our installed wind energy capacity. Yes, it is not particularly windy right now. But when it is, that’s an awful lot of wind energy going to waste. Surely there is a more efficient system?

There’s no incentive for energy producers to solve this — they are getting paid handsomely by our government. Our government also seems to have plenty of other priorities to contend with.

It's not as if we don’t have the technology. Battery prices have dropped significantly in the past few years. Smart, AI-driven systems can now charge up when prices are low, and dispatch when prices are high. Some energy suppliers will even pay you to use power at off-peak times. If all of us tapped into this technology at home, imagine the savings we could achieve as a nation.

There are sure to be many other practical challenges, of course — increased capacity to transmit energy across the country being one of them. But if you’re looking for a spark of a business idea, then providing a solution to this conundrum, feels like it has potential for some seriously high voltage — both environmentally and financially.

I’ll elaborate through the following sections:

Green Home Upgrades = a Financial Investment?

Green Home Upgrades = Geopolitical Insurance?

Heat Pumps: Destroying the Myths

A Lesson from Bhutan

Green Home Upgrades = a Financial Investment?

Return of Investment (ROI)

For a bond investment, we exchange some cash up-front for the bond, and in return we receive some future interest payments. If these total more than our initial cash payment, we get a positive return on investment.

In the same way, a green home upgrade, like adding insulation, solar panels, a battery, or a heat pump, requires a cash payment for installation. In exchange, we expect to receive regular future savings on our energy bills, compared to if we had not gone ahead with this. If the total of these energy bill savings are greater than our initial cash outlay, we again get a positive return on investment.

Numbers are highly dependent on assumptions. But here’s some analysis to help provoke your interest:

Project Ambient has a headline statistic “switching from a gas boiler to a heat pump could save a UK three-person household £465 a year”. They also have a useful calculator, if you’d like to see a more specific number.

As Which? Magazine explain, this is all dependent on switching to a “time-of-use” or heat pump specific energy tariff.

The Eco Experts have the cost of an air source heat pump for a 3-bedroom house at an average of £10,000 for supply and install (and ranging from £7,000 to £15,000 depending on number of bedrooms).

The current UK government subsidy for heat pumps is £7,500, giving a net cost of £5,000.

In my actuarial job, my team put together a monthly market monitor where we include a forecast of future inflation. Currently the bond markets are implying a future inflation of just under 3.5% over the next 15 years. 15 years corresponds to some of the performance guarantee periods offered by heat pumps.

Pulling this altogether would give a return of 8.1% per annum over 15 years, which is quite a healthy number! This does NOT mean all heat pumps deliver a return of 8.1%. This is number is dependent on simplistic assumptions. In particular (1) cost and savings will vary depending on your household; and (2) future energy price inflation may not be be 3.5%.

But it is an example that is intended to hopefully provoke you into thinking what could be possible — that there could be net financial benefit over the longer term. That is if you have the cash to make the upgrade in the first place.

Return on Capital (ROC)

15 year is a long time. Many may choose to sell up and move house in that time. So the question becomes, will I get compensated for the money spent?

A number of research studies show that green or energy efficient homes lead to an uplift in value greater than cost spent. Rightmove has 15%, Knight Frank 4% and RICS 9%.

So the likelihood is “yes”.

Green Home Upgrades = Geopolitical Insurance?

It is crazy to think that it is now almost 3.5 year ago that a certain Russian dictator decided to invade their sovereign country neighbour. It continues to be heart-breaking to hear about the many lives lost in the ongoing war with Ukraine.

The implications of the war also rippled across the world in the form of the highest energy price inflation we have seen in years.

Energy prices (as shown in the graph above) surged in 2022 and haven’t settled since. With global instability showing no signs of slowing, generating your own power — or tapping into cheaper overnight rates with a battery or heat pump timer — could help better shield your household from any future repeat of the 2022 geopolitical chaos.

Heat Pumps: Destroying the Myths

Heat pumps are starting to gain attention — but so is the misinformation.

Sales have started to increase sharply in the UK – up 63% in 2024 compared to the year before. But we are still way behind Europe with only 0.4% in the UK compared to 3.0% in Europe using a heat pump. Interestingly, for those looking for a career shift, the heat pump industry could create 53,000 new jobs in the UK — plenty of need for new talent.

With headlines often skewed by misunderstanding or vested interests, it’s no wonder many people are still unsure. Courtesy of the Energy Savings Trust, here is a plain and simple fact check summary:

❌ “They’re noisy.”

Not really. Most heat pumps are about as loud as a fridge — 40-60 deciBells. If it’s unusually noisy, it probably just needs a service or a level base.

❌ “They cost more to run than gas.”

At today’s standard tariff prices, running costs are similar to a new gas boiler — and cheaper than older ones. As explained above, though at time-of-use tariff prices, running costs could be significantly cheaper.

They're 3–4x more efficient to run. The only reason they don’t yet deliver massive savings at standard tariff prices is the UK’s high electricity prices, which are still tied to gas.

❌ “They don’t work in the cold.”

Wrong again. Most heat pumps work down to -25°C. Norway, Sweden, and Finland all rely on them — and they’re a lot colder than the UK.

❌ “You need all new radiators.”

Not necessarily. Bigger radiators help, especially with low-temperature heating, but your installer will advise based on your current setup.

❌ “Your house needs to be fully insulated.”

Good insulation helps, but it’s not essential. Installers can design systems to suit even older or less insulated homes.

❌ “They’re hard to maintain.”

They’re no trickier than a gas boiler — just get an annual service. Most issues stem from poor installation, so use an MCS-certified installer.

✅ “Will it keep me warm all year?”

Yes. A properly sized and installed system will keep your home toasty, even in the depths of winter — no backup heater needed.

A Lesson from Bhutan

Finally, going back to the problem of our wasted excess wind energy in the UK. Greater usage of time-of-use tariffs in the UK could be one way to try solve this. However, a really interesting proposition I’ve been discussing with some experts in this field recently is: Bitcoin.

Many previous critics to Bitcoin questioned whether it really has a use case. I’ve talked previously about one use case as a “systemic risk hedge”. Akin to a “digital gold” — designed to hold value as traditional currencies come under pressure, in a scenario of government debt balances getting out of control.

Bitcoin mining is known for it’s high energy usage. An alternative way to think of that is to consider bitcoin mining as a way to “monetise energy” — a second potential use case. In one of my favourite recent news story revelations, that is exactly the vision that Bhutan has had since 2020.

Back in late 2020, King Jigme Khesar Namgyel Wangchuck of Bhutan launched what many saw as a bold, even outlandish idea: using Bitcoin mining to monetise the country’s surplus hydropower. Four years on, the results speak for themselves. Bhutan has generated $1.3 billion — nearly 40% of its GDP — by converting excess renewable energy into digital assets. Some of that windfall has even funded pay rises for civil servants.

It’s a strategy the UK might want to pay attention to. Imagine if Rachel Reeves and the UK government invested in Bitcoin mining powered by Scotland’s excess wind energy. Instead of paying wind farms to switch off during periods of oversupply, the UK could be earning income — and using it to give our nurses, teachers, and doctors the pay bumps they’ve long deserved.

That kind of move wouldn’t just shift the economics of Net Zero — it could completely reshape the politics of it too. All inspired by a bold move from a small but forward-thinking nation in the Global South.💡🌍🚀

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.