Is It Risky to Go Green with Your Pension?

Why sustainable investing might be smarter than you think — Going green with your pension doesn’t necessarily mean losing returns. This article busts the myths and shows how your pension can drive climate action and build long-term financial security.

💭 A Myth That Won’t Die: “Green Means Lower Returns”

London Climate Action Week last week provided a networking haven for eco-conscious enthusiasts. It was a great chance to mingle and meet. Much talking about how to keep moving forward despite the recent headwinds.

I spoke to some about their investing intentions. I was surprised to hear reticence about the idea of investing their pension sustainably. Some expressed a genuine nervousness about the thought of green investing leading to lower returns, and a less affordable retirement as a result. It goes to show how persistent a perception there is that “green means lower returns."

There is an evident desire to invest in doing good. A recent PensionsAge survey shows 54% have thought about aligning pensions with values. But the follow-through falls significantly short — only 24% actually have done so. (This actually sounds pretty high to me!).

While apathy is likely a big factor, how much is the concern of performance also acting as a hindrance? Based on my own recent market research, 90% of people said sustainability is important for purchasing decisions. So, why does that not translate through to investing?

This week’s article aims to challenge the belief that sustainability means giving up long-term financial returns. To help dispel that myth.

The angles I’ll cover:

· Why Today’s Winners Might Be Tomorrow’s Dinosaurs 🦖

· The “Green Premium”: Is This Cycle Any Different? 🔄

· Out of Favour ≠ Poor Investment 📉

· What the Research Actually Says 🔬

· So Why Aren’t More Pension Funds Doing This?🤷♀️

📆 Long-Term Lens: Why Today’s Winners Might Be Tomorrow’s Dinosaurs🦖

Short-term bumps vs. 25-year transformations

There is no doubt that in recent times, when the oil price has surged, fossil fuel companies have profited. They’ve outperformed their ESG peers as a result. But we shouldn’t forget, we’re talking about short-term performance.

Pensions are all about long-term performance — decades, not quarters. For someone who is 40-years-old today, they are not able to access their pension in the UK for another 15 years. They are not likely to do so for another 25 years.

What does 25 years’ difference feel like? Let’s rewind back to 2000.

Some big corporation stocks at the time:

Nokia📱 — missed the smart-phone transition. It then lost significant value.

Kodak📷 — missed the digital photography transition. Now a shadow of its former self.

Sears🛍️ — it lost out to Walmart & Amazon, and ended up bankrupt in 2018

Enron📦 — succumb to an accountancy scandal in 2001

Lehman’s💰— the big victim of the 2008 Global Financial Crisis

Short-term confidence, does not necessarily translate into long-term survivability. The last example is quite telling. The credit crisis was a big systemic risk that built for years. There were many warning signs along the way that were ignored by the financial markets, until a sudden realisation in 2008. Could history repeat itself?

20-30 years is a length of time, where significant transitions have taken place in the past — just like the shift from horses to cars in the US:

1900: ~95% of urban transport in the US was horse-powered 🐎

1930: The car had almost entirely replaced the horse for everyday transport in the US 🚗

Today’s shift comes with deliberate intention — it’s called Net Zero. The is no certainty around the time it will take. But it is progressing in one direction, and there is a fair chance we will actually achieve it.

Key questions to ask yourself:

What will the economy look like when you retire?

What companies could likely thrive then?

💸The “Green Premium”: Is This Cycle Any Different? 🔄

Understanding pricing trends and timing effects

If you look at the data, it is true to say there has at times been what’s called a “green premium”. Some investors have been willing to pay more for so-called “ESG” stocks of companies that demonstrate they are doing good. More demand, means higher relative prices paid, and potentially lower returns as a result.

ESG was booming through the 2010s, as more of these funds became available. In recent times, political backlash (e.g. particularly in the US) has reversed this trend. However, we are also now seeing signs of a backlash to the backlash.

This sort of market sentiment is cyclical — and so are stock valuations.

The good news is that pensions require regular contributions. This helps smooth out the impact of these cycles — what is called "pound-cost averaging".

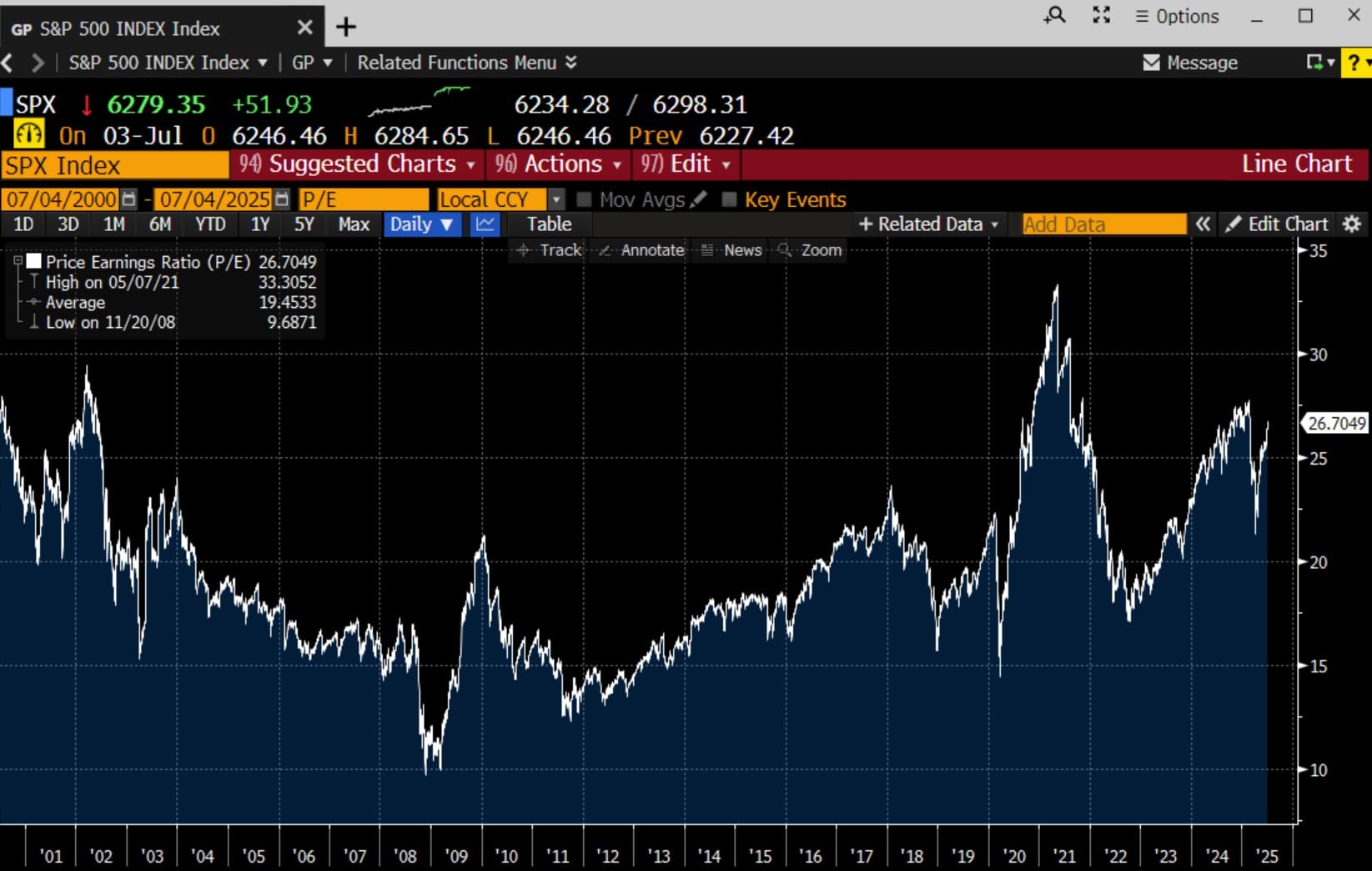

A bigger worry is how people feel about investing in stocks overall. This is shown in metrics like the "price-to-earnings ratio". This shows how much investors are paying for expected dividends. Right now, US equities are trading above 25 — a sign they’re expensive. But this isn’t a reason to stop investing. Markets rise and fall, and regular investing helps balance it out over time.

Out of Favour ≠ Poor Investment 📉

Buffett-style thinking: Buy when others are fearful

If anything, given that ESG has fallen out of favour recently — many interpret this as a buying opportunity signal, not a risk.

Think Warren Buffett’s famous advice: “Be greedy when others are fearful.”

A recent survey from Morgan Stanley found that 59% of investors plan to boost sustainable investments next year. The main reason is their confidence in performance.

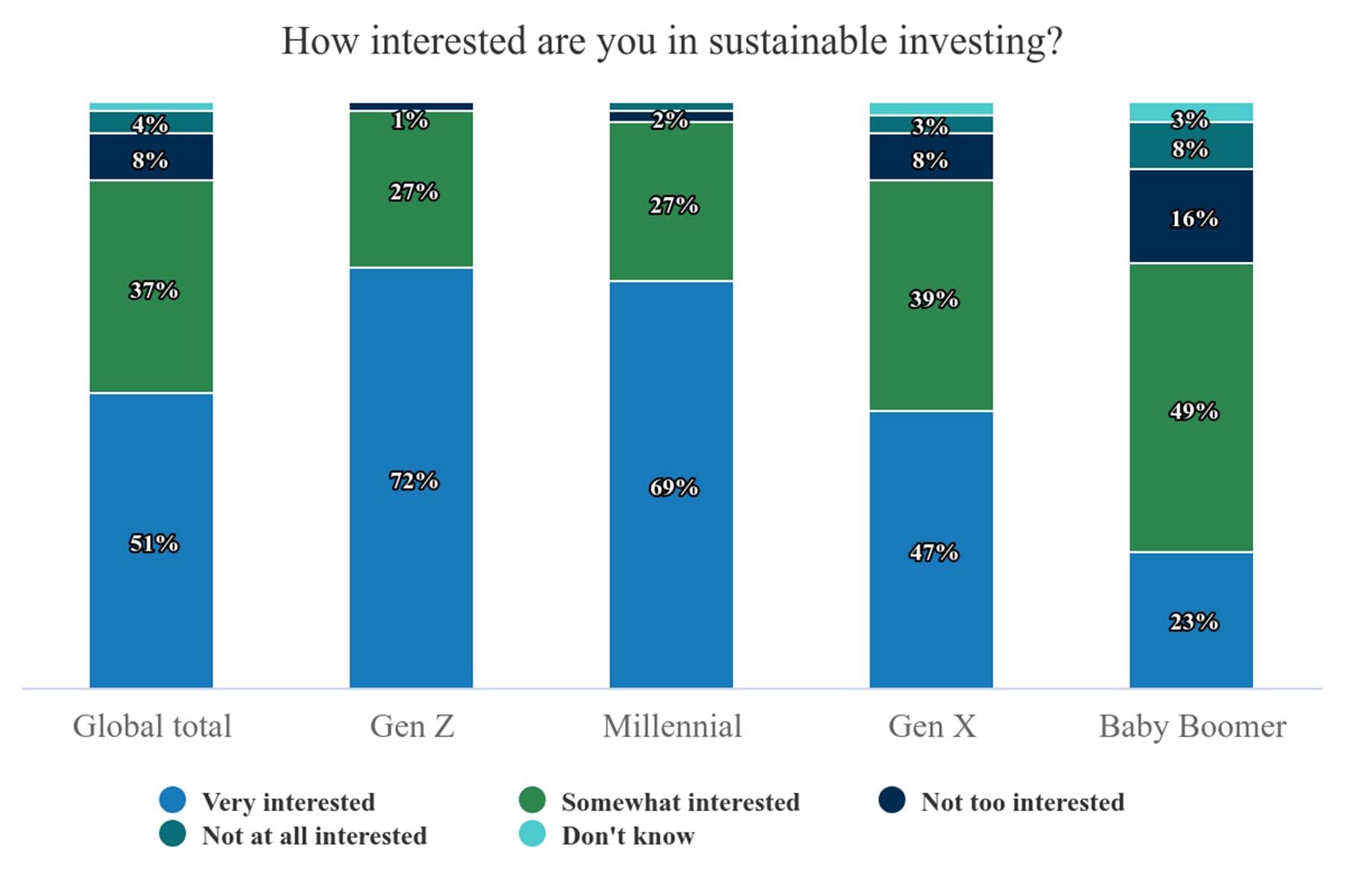

Interest in sustainable investing worldwide stays strong. About 51% are very interested, and another 37% are somewhat interested. This has remained relatively stable since 2022.

As expected, interest is keenest amongst younger generations:

What the Research Actually Says🔬

Evidence that ESG doesn’t harm returns — and may enhance them

For many, true conviction needs to be backed up by academic rigour. There are no shortage of academic studies that challenge the “return sacrifice” narrative.

The UN PRI has compiled a useful list of academic studies. The overall conclusion, ESG is either neutral or in some cases demonstrates improved returns.

- MSCI 17-Year Study: shows that top-rated ESG companies did better in both developed (17 years) and emerging markets (11 years) up to December 2023. This success came from stronger earnings, not just higher valuations.

- Kroll: Analysed over 13,000 companies from 2013 to 2021. They found that companies with higher ESG ratings usually had better returns than those with lower ratings.

- McKinsey (2016–2022): Companies balancing ESG and profit had superior shareholder returns.

- Rockefeller Meta-Study: ESG integration helped with long-term performance, risk reduction, and resilience.

- Abrdn: ESG improves downside protection, especially in emerging markets and bonds.

- Vanguard: Studied the Russell 3000 and found weak links between ESG ratings and returns — results varied by time period. Style factors were more important for explaining performance.

So Why Aren’t More Pension Funds Doing This?🤷♀️

Structural hurdles holding back a sustainable future

Pension trustees must legally act in members’ "best interests" — and that’s a good thing. It’s why pensions remain one of the safest, smartest ways to save for the future.

However, how do you define “best interests”?

Pensions are long-term investments. But short-term performance still carries huge weight in the industry. If a fund does worse than its peers in the short term, trustees might worry. They may fear being questioned about not acting in members’ “best interests,” even if the long-term strategy is solid.

ESG screens leave out some sectors, which limits diversification — fewer eggs in the basket. That can raise concerns about increased risk, and whether that’s truly in members’ best interests. Although a question to this is: what about systemic risk for the future? There are changes afoot in some pension funds, in how you should define risk.

A key factor in a competitive pensions market is cost. This is especially true for default funds, where most people's money is invested. Lower cost means less to spend on investment managers. ESG is ultimately a more complex and expensive strategy to manage compared to something plain vanilla.

There’s an ongoing mindset shift in the pensions industry — a growing belief that "best interests" is about long-term value (not just headline cost). But delivering that value often requires spending more, and the industry hasn’t fully made that leap yet.

Many pension platforms do offer greener alternatives, which you can switch into. For many, this is enough. They offer the choice and let members find it. If it matters that much to a member, they need to put in the effort to make a change.

What's needed is more member pressure to change the default fund. That's why contacting your pension fund to express your views can matters. Enough weight of support, and the minds of those running pension funds may have to take note.

Final Thought: Your Pension Could Be Your Most Powerful Climate Tool🌱

Don’t let fear or misinformation hold you back

You don’t have to choose between a secure future and a liveable planet — you can have both.

Pensions are long-term, steady investments — exactly what’s needed to fuel the transition to a greener economy. And if 90% of us care about sustainability when we shop, isn’t it time our savings reflected that too?

As mentioned, many pension providers now offer greener investment options — but it often takes a bit of digging to find them and request the switch. If you’re not sure where to start, the Planet Positive Planning Investing Guide can help you understand what to look for and how to take action.

Don’t let myths or inertia hold you back. Your pension could be one of the most powerful tools you have to drive real-world change — while still securing your own future.

Want some practical tips on what to do? Hit reply, and let’s talk.

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.