Rollercoasters & Pensions

Discover how to take control of your financial future with this practical, planet-positive guide to UK pensions — covering types, consolidation, ethical investing, SDR labels, and how to kick-start action with your own Pension Power Hour.

Back at work this week, it feels like I missed a wild rollercoaster ride in the financial markets! My trading team says they haven’t seen this kind of volatility since the 2020 pandemic. It seems I somehow timed my holiday perfectly to avoid the various market gyrations, and return once again to calm. Equity markets are right back where they were before I left — at least for now. We'll await to see what happens in early July when the 90-day pause on tariffs expires.

That said, how many of you checked the value of your pension last month? Pensions tend to be something that sit in the background and forgotten about. During your working life, that could ultimately be a good thing, to miss out on seeing their gyrations in value, and any potential emotional stress that comes with it. Pensions are about long-term investing. Short-term volatility, like we saw last month, is just part of the ride. Nothing to worry about.

However, at the same time lack of awareness can be risky. Planning ahead gives you control and helps shape the life you want. That means checking if your pension is on track, and being ready to act if it’s not. It’s also worth thinking about what later life looks like for you — pensions matter, but they’re not the only piece of the puzzle. It's all about achieving a "harmonious balance".

Pensions are a common source of questions with my clients. Hence the topic for this week's article. It includes a round-up of practical info curated from various sources, to help demystify the topic and share some best practices. Hopefully, there’s something useful here for you.

Pensions are also an underappreciated source of impact for good. The enlightening statistic from Make My Money Matter is that greening your pension can cut your carbon footprint 21 times more than going veggie.

If like me cutting out meat altogether is proving a challenge, you might firstly take solace in taking action with your pension instead. Hopefully the information to follow helps to empower you to take control. Then secondly, how about incorporating a lentil dahl curry into your regular cooking? 😀 — tasty, nutritious, easy-to-cook protein, and personally one of my favourite things!😋Here's a lesson from the lovely Sandhu who taught me how to cook this in Unawatuna last week.

But back to Make My Money Matter, and it's sad to hear that after their rollercoaster 5 years of campaigning, they are bringing their efforts to a closure. Their messages and materials will live on though. They have been the driving force for tangible impact — most UK pension schemes have now committed to invest our money in ways that try to limit global warming below 1.5°C, including halving their emissions by 2030. They now pass the torch on to others — the Finance Innovation Lab, Bank Green and Bank Better — to continue to strive for still urgent and critically needed change. More info provided below.

As always, feel free to hit the reply button, with questions, comments or feedback you may have. I reply to every email I receive. I'm always excited to hear from readers, and also happy to accommodate any topic suggestions for future articles.

Wherever you are reading this from, hope you are getting to make the most of this glorious weather in the UK this weekend! Enjoy 😎

Pensions 101: What They Are, Why They Matter, and How They Work

A pension is a long-term savings plan designed to give you income in retirement. Think of it as building your future salary – a pot of money you (and often your employer) save into over time, which is then invested in things like shares, bonds, and property. When you stop working, you draw from that pot to support your lifestyle.

There are three main types of pensions in the UK:

State Pension

Provided by the government, this is a baseline income you can claim once you reach State Pension age (currently 66, rising to 67 between 2026 and 2028, and likely 68 in the future).

- To qualify for the full State Pension, you need 35 years of National Insurance (NI) contributions. You can check your NI record here. If you believe you will get to retirement without a full 35 years, you can also pay to top-up your contributions – for more on the pros and cons see here.

- With at least 10 years, you’ll still receive a partial pension.

- As of 2024, the full amount is around £203.85 per week, or just over £10,600 per year.

- The State Pension increases each year via the Triple Lock – rising by the highest of inflation, wage growth, or 2.5%.

Defined Contribution (DC) Pensions

These are the most common today, especially for private-sector workers.

- You and your employer pay into a pension pot. The size of your retirement fund depends on how much goes in and how well the investments perform.

- You’re usually automatically enrolled if you earn over £10,000/year, are aged 22+, and work in the UK.

- Total minimum contributions are 8% of your salary: 5% from you, 3% from your employer.

- At age 55 (rising to 57 in 2028), you can access your pot, typically:

- 25% tax-free, and

- The rest as regular income, drawdown, or an annuity (subject to tax).

Defined Benefit (DB) Pensions

Also called “final salary” pensions, these promise a guaranteed income for life based on your salary and years of service.

- Mostly found in public sector roles (like NHS, teachers, firefighters).

- The amount you get is fixed by the scheme’s rules and isn’t affected by investment performance.

Other Types of Private Pensions

SIPP (Self-Invested Personal Pension): Great for self-employed or hands-on investors. Offers full control over how your money is invested, with the same tax perks as other pensions. As the name suggests, this is just set up and invested by your personally, and not by your employer.

SSAS (Small Self-Administered Scheme): Typically used by directors of small businesses. Offers advanced options like buying company property or making secured loans.

Why Bother With a Pension?

Because living off just the State Pension – currently around £10,600 a year – is barely enough for a basic lifestyle. Pensions give you financial independence in retirement, and they come with three major perks:

- Free money from your employer (usually at least 3% of your salary).

- Tax relief – the government tops up your contributions.

- Investment growth – your money works for you while you work.

Pensions are often the most tax-efficient way to save for the long term. That said, there are other ways to generate income in retirement — rental properties, income-producing assets, or even using your skills through part-time work or entrepreneurial ventures.

Diversification shouldn’t stop at your pension fund; it can make sense to spread risk across different income sources. Relying solely on a pension, means having your lifestyle more dependent on the gyrations of the financial market. While pensions are important, they don’t offer you purpose, mental stimulation, or social connection. They're just one part of a more "harmonious balance" later in life.

How Much Can You Pay In?

If you’re employed and earn over £10,000/year, you’re auto-enrolled into a pension. Typically, you contribute 5% of your salary, and your employer adds 3%. You can contribute more if you choose – up to £60,000 a year without facing tax penalties (or less, depending on income and access to your pension).

Taking Your Pension: What Are Your Options?

Once you reach the minimum pension age (currently 55, rising to 57 in 2028), you can:

- Take 25% of your pot tax-free.

- Use the rest to buy an annuity (fixed income), enter income drawdown (flexible withdrawals), take it all as cash, or combine approaches.

Meanwhile, the State Pension kicks in separately from age 66+. It’s guaranteed for life, rises each year, and there is the option to defer for a larger weekly amount later.

Should I Consolidate My Pension?

Bringing multiple pensions into one pot can simplify your retirement planning — often it generally makes sense, but there are some circumstances where there are downsides to this.

Potential Benefits:

- Simpler management – track and manage everything in one place

- Clarity – see how your pension is performing overall

- Lower fees – some providers offer more competitive charges

- Better tools – modern platforms often offer useful apps and dashboards

- Flexible options – more choice in how you access your pension in retirement

Things to Watch Out For:

- Loss of valuable benefits – some old pensions include perks like guaranteed annuity rates or earlier retirement ages

- Final salary schemes – these are usually best left untouched due to guaranteed income benefits

- Not always cheaper – transferring could mean higher fees or fewer investment options, depending upon which pension fund you select

- Takes time – you’ll need to check details and compare providers carefully

- Automatic small pots consolidation in future – the UK government is intending to implement a mechanism to automatically consolidate small pension pots (under £1,000 in value) from 2030 onwards. While go ahead has been confirmed (for more info see), not all details are finalised. The intention is for this to save you money. However, there is no guarantee on how much you would save.

Before you make a move, check your current pensions for any protected features, and consider reading an impartial guide like this one from Investing Reviews.

The first step is to find all pensions that you have contributed to in the past. The government offer a pension tracing service to help you do this easily.

What Happens to Your Pension if You Move Abroad?

You can still receive your UK pension abroad, but there are important considerations to keep in mind:

- Personal and workplace pensions can usually be paid into UK or overseas accounts, though currency exchange rates may affect how much income you can receive in local currency month to month.

- The UK State Pension can also be claimed overseas, but it only increases annually if you live in certain countries (like the EEA, Gibraltar, or those with a UK social security agreement).

- Tax implications can get complicated. You might be taxed both in the UK and your new country of residence unless there’s a double taxation agreement. This is often the case, but always seek cross-border tax advice.

- If you move before accessing your pension, you may still contribute, but tax relief might be limited or unavailable unless you meet UK residency criteria.

- You can’t build new UK State Pension entitlement while working abroad unless you're paying UK National Insurance or in a qualifying country.

📌 Tip: Notify your pension provider and the International Pension Centre before you move, and consider financial advice on overseas transfers or QROPS if relevant.

More Information?

Pension Wise (provided by Money Helper), is a free service provided by the UK Government that is a useful source of information, and free guidance for those over 50 years old. You can book a free appointment with them to talk through any questions - see here.

Some other useful sources of information are: UK Government and MoneyGrower.

How do I Green My Pension?

Your pension could be one of the most impactful tools you have to fight climate change — and most people don’t even know it.

UK pensions collectively hold trillions of pounds, much of it invested in fossil fuels, deforestation, arms, and industries driving ecological collapse. By shifting your pension to more sustainable funds, you’re not just saving for the future — you’re shaping it.

Is Your Pension Provider Doing Enough on Climate?

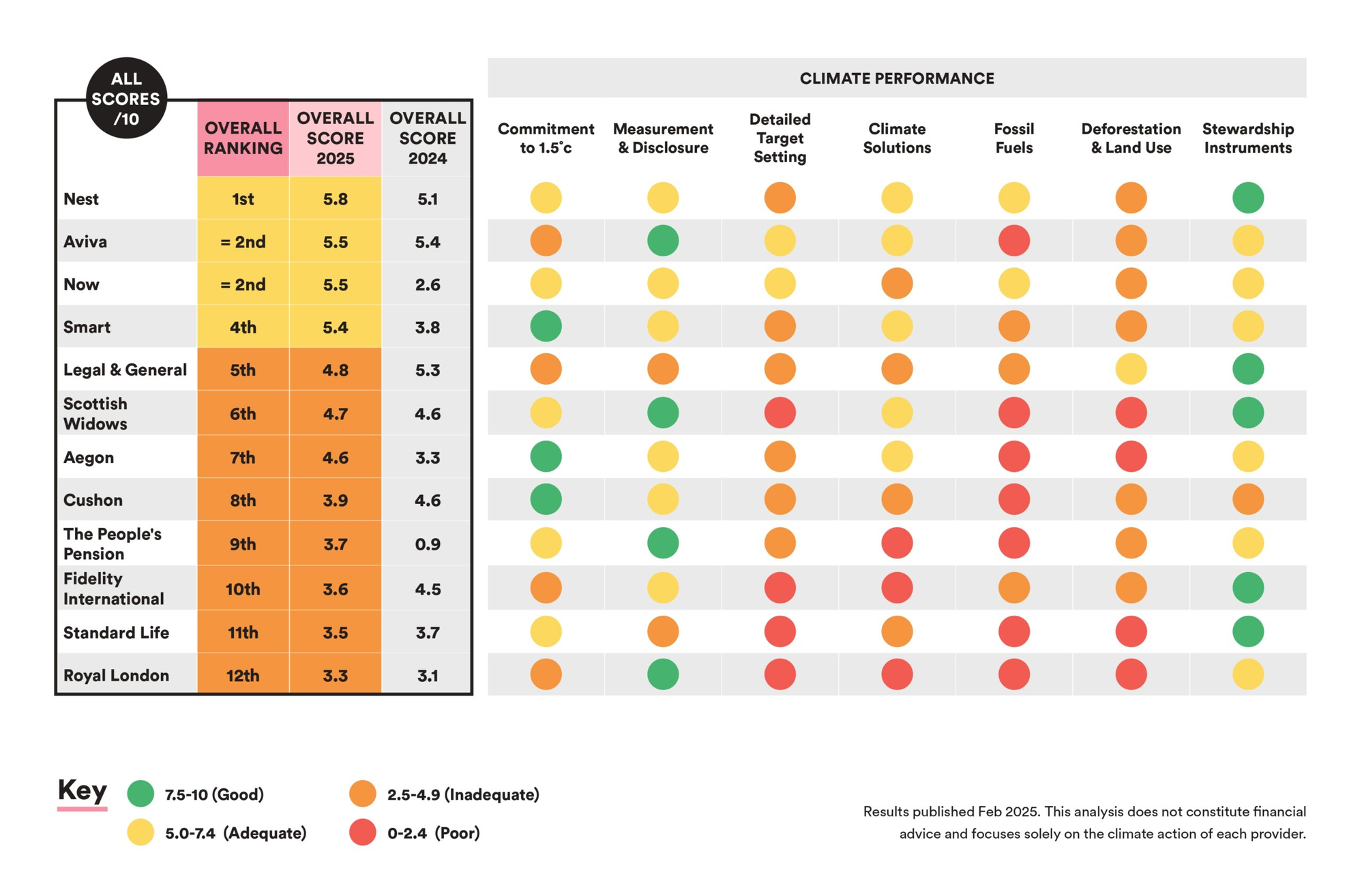

According to the Climate Action Report 2025 by Make My Money Matter, the UK’s largest pension providers aren’t all pulling their weight when it comes to climate responsibility.

The report ranks the top 12 providers on the credibility and ambition of their climate plans — including their net-zero commitments, fossil fuel exclusions, and voting power as shareholders.

🔍 Key takeaway? Some providers are walking the talk. Others are still stuck in polluting portfolios. See the table below.

Please note: this table focuses on providers’ climate change performance. Other factors should also be considered when choosing a pension provider. This is for information only and does not constitute advice on overall suitability.

📄 Read the full report from which this table is sourced here: Make My Money Matter – Climate Action Report 2025

Steps to Green Your Pension:

- Find out where it’s invested

Contact your provider or check your online portal to see your current fund choices. Look for ESG (Environmental, Social, Governance), sustainable, or ethical options. - Switch to a greener fund

Your pension will likely be invested in the "default fund", which will not necessarily be the greenest option. Many workplace schemes now offer sustainable fund options — though the quality varies. Ask your provider:

“What is your most climate-friendly fund, and what’s excluded from it?” - Push for change

If your pension provider doesn’t offer sustainable options, ask them to. The more people speak up, the faster they’ll act. - Consider an ethical SIPP

If you want full control, a Self-Invested Personal Pension (SIPP) allows you to choose funds aligned with your values — from clean energy to social impact investing. - Watch out for greenwashing

Not all “green” funds are truly sustainable. Look under the hood: Does the fund exclude fossil fuels and deforestation? Does it vote in favour of climate action?

📌 Your money doesn’t sit idle. It’s funding the world you’ll retire into. Make sure it’s building the kind of future you’d actually want to live in.

What Are SDR Labels – and Why Should Self-Investors Care?

If you're managing your own pension through a SIPP (Self-Invested Personal Pension), understanding SDR labels can help you cut through the greenwash and invest with real impact.

The UK’s Sustainability Disclosure Requirements (SDR), are a new set of rules implemented by the regulator, designed to bring transparency and accountability to sustainable investing. They require fund managers to clearly label investments that make credible sustainability claims.

The Four SDR Labels:

- Sustainability Focus

Funds that invest in assets meeting specific sustainability standards — like low carbon emissions or strong labour rights. These funds aim to “do less harm.” - Sustainability Improvers

Invest in companies making meaningful progress toward sustainability, even if they’re not there yet. Think of this as a “transition” label. - Sustainability Impact

These funds aim for measurable, positive real-world outcomes — like cutting emissions, restoring biodiversity, or providing clean water. The highest bar for ethical investing. - Sustainability Mixed

These funds have a mixture of the 3 previous goals.

Why This Matters for Your Pension

- Clarity: These labels help you distinguish between funds making genuine efforts and those riding the ESG marketing wave.

- Alignment: You can now select funds that match your values and understand what kind of impact they’re having.

- Accountability: SDR labels come with strict reporting rules, so providers must back up their claims with evidence.

Looking for an SDR-Labelled Fund?

Take a look to this free tool that financial advisers use: Fund Eco Market

Fund Eco Market is a free, specialist database designed to help UK financial advisers and wealth managers compare and understand sustainable, responsible, and ethical investment funds. Launched in 2011, the platform brings together a wide range of SRI strategies in one place, making it easier to match client values with appropriate investment options.

While tailored for professionals, the site is open to all and supports transparent, values-based investing by removing barriers to information. The service is funded by participating fund partners, ensuring access remains free and independent for users.

To be clear, this database provides information only, and not specific investment advice on the suitability of funds mentioned.

📌 If you’re building your own pension portfolio, start looking for SDR-labelled funds as they roll out. These labels can help you invest with your eyes open — and your conscience intact.

Have I Got Enough in My Pension?

That depends — but not just on the numbers.

To answer this honestly, we need to start with a deeper question: what does “enough” look like for you?

This isn’t just about money. It’s about the shape of your future life — how you want to live, what you value, and what kind of legacy you hope to leave. These are big, meaningful questions. And they deserve thoughtful, structured reflection.

That’s where the Planet Positive GAME Plan comes in. It’s a guided process that helps you define your ideal life with clarity and purpose — so that your financial decisions serve your real vision, not just an abstract number.

Once you have that vision, our accompanying tool HAPNAV (the "Happiness Navigator") is designed to assess whether your current trajectory supports it — and suggest practical steps if there’s a gap between where you are and where you want to be.

Because the question isn’t just have you got enough?

It’s enough for what kind of life?

Time For Action: "Pension Power Hour"

Hopefully the information in this article has been useful to you. But to be truly useful, requires you to take action.

A minority of us are really where we want to be with our pension arrangements. Whether it be consolidating in one place, or having our pension invested where we would prefer it to be. I'll be honest, that minority doesn't include myself (!) — I still have actions on my own personal to-do list that I need to take.

One of the main challenges with life and financial planning is prioritisation. Really appreciating the importance of your future self, future loved ones and future life, and following through with prioritising your future accordingly.

So before you click away from this article, I have a challenge for you. Get your calendar out. Allocate a 1 hour timeslot to yourself. Call it the "Pension Power Hour" — an hour to reflect on where you are and create a plan to act — whether it be consolidation, finding those lost pensions, changing provider, ethical investment, or a combination. You don't have to have done everything within the hour, but the target is to set yourself with a clear list of actions.

Treat this hour as you would any client meeting — the client being your future, your loved ones and the planet. If you need to reschedule, apologise to yourself profusely, make sure you reschedule and avoid deferring again.

My "Pension Power Hour" is booked in for 5pm next Thursday 8th May.

When is yours?

Once you've committed to this and followed through, I'd love to hear from you — any questions, happy to answer. Any actions taken, please do share and celebrate. Let's make this a collective effort! Good luck! 😄

Disclaimer:

The information provided is for general informational purposes only and does not constitute investment, financial, tax, or legal advice. Please be aware that an investment strategy that is appropriate for one person, may not be appropriate to another, including yourself. Past performance is not indicative of future results. In tailoring your own personal investment strategy it is recommended to speak to a qualified professional.